Making The Most Of Claims Negotiations: The Power of Independent Adjuster Firms

Expert Overview to Coming To Be an Independent Insurer in the Insurance Sector

Embarking on a profession as an independent adjuster within the insurance coverage market requires a careful understanding of the detailed operations of this customized area. From sharpening crucial skills to obtaining the required licensure, the journey to ending up being a successful independent adjuster is complex and needs a tactical strategy.

Understanding the Independent Insurer Duty

Understanding the function of an independent insurance adjuster involves thoroughly assessing insurance claims to figure out exact negotiations. Independent adjusters play a critical role in the insurance policy sector by examining insurance claims, examining policy details, examining property damage, and evaluating the degree of insurance coverage. These professionals act as objective third parties, servicing behalf of insurance provider to ensure reasonable and timely claim resolutions.

In order to precisely analyze cases, independent insurance adjusters should possess a strong focus to information, logical skills, and a deep understanding of insurance plan and policies. They have to carefully assess paperwork, gather evidence, and interview relevant events to make educated choices concerning claim negotiations. Independent insurers also need superb communication skills to effectively discuss with complaintants, insurance coverage companies, and various other stakeholders associated with the claims procedure.

Vital Skills and Qualifications

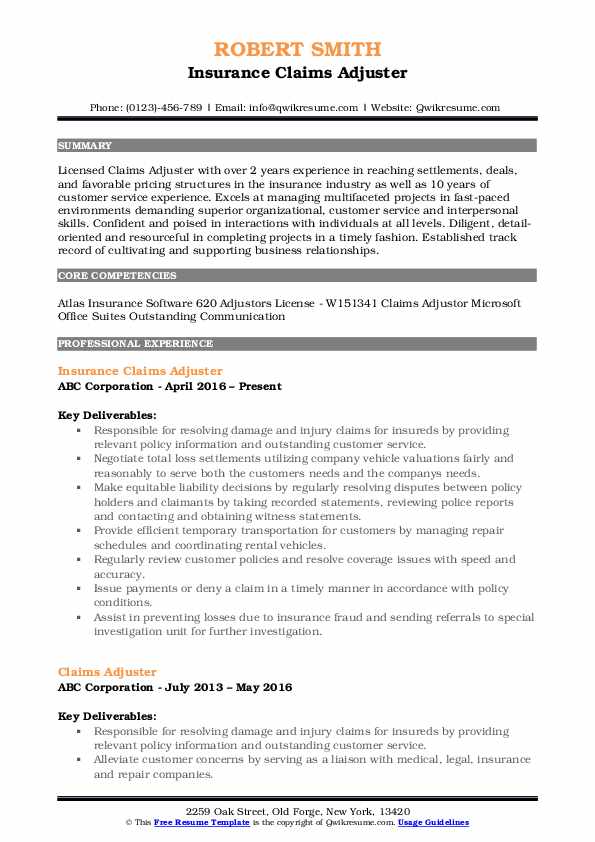

Possessing a varied collection of certifications and skills is imperative for individuals intending to succeed as independent insurers in the insurance coverage sector. Independent adjusters must possess exceptional communication abilities to properly communicate with customers, insurance policy business, and various other professionals in the field.

Moreover, having a solid understanding of insurance coverage procedures, concepts, and laws is vital for independent insurers to browse complex claims processes successfully. independent adjuster firms. Effectiveness in computer software and technology is significantly crucial for handling insurance claims successfully and preserving exact documents

A background in financing, organization, or a relevant area can supply a solid structure for aspiring independent insurers. Acquiring pertinent certifications, such as the Accredited Claims Insurance Adjuster (ACA) classification, can also boost integrity and show a dedication to professional development in the insurance coverage sector. By sharpening these vital abilities and qualifications, individuals can position themselves for success as independent adjusters.

Navigating Licensing and Certification

Having obtained the crucial skills and certifications required for success as an independent adjuster in the insurance coverage sector, the following important step entails navigating the details of licensing and qualification demands. In the United States, independent insurers are commonly required to obtain a license in each state where they plan to work. The particular requirements for licensure differ from one state to another but typically consist of completing a pre-licensing education and learning training course, passing a licensing test, and undergoing a background check. Some states might also need insurers to fulfill proceeding education demands to maintain their licenses.

Additionally, obtaining expert certifications can improve an independent adjuster's integrity and marketability. Organizations such as the National Organization of Independent Insurance Coverage Insurance Adjusters (NAIIA) and the American Institute for Chartered Property Casualty Underwriters (AICPCU) use accreditation programs that cover various elements of the adjusting procedure. These accreditations demonstrate a commitment to professionalism and continuous education and learning within the field, which can set insurance adjusters apart in a competitive market (independent adjuster firms). By fulfilling the licensing and understanding and qualification needs, independent insurance adjusters can place themselves for success in the insurance sector.

Structure Your Adjusting Profile

To establish a strong structure for your career as an independent insurer in the insurance coverage market, concentrate on establishing a durable adjusting portfolio. Your adjusting portfolio must display your skills, experience, and expertise in handling insurance coverage claims efficiently and properly. Consist of information of the types of claims you have actually serviced, such as residential or commercial property damage, obligation, or vehicle accidents, and highlight any specialized expertise you have, like handling insurance claims in specific sectors or areas.

When constructing your adjusting profile, consider including any type of pertinent qualifications, licenses, or this page training you have finished. This will certainly show your commitment to expert development and your integrity as an adjuster. Furthermore, consisting of testimonials or references from previous clients or companies can assist validate your skills and dependability as an independent insurance adjuster.

On a regular basis upgrade your readjusting portfolio with brand-new experiences and achievements to ensure it remains existing and reflective of your capabilities. A well-organized and comprehensive adjusting profile will certainly not just attract prospective clients however also assist you stand apart in an affordable insurance market.

Networking and Discovering Opportunities

Establishing a strong expert network is crucial for independent insurance adjusters aiming to locate brand-new opportunities and broaden their client base in the insurance coverage sector. Networking permits adjusters to get in touch with vital sector experts, such as insurance policy service providers, claims managers, and various other insurance adjusters, which can cause recommendations and new assignments. Going to sector events, such as seminars and workshops, provides useful networking opportunities where insurers can meet possible clients and find out about emerging patterns in the insurance area.

Final Thought

Finally, aiming independent insurers should have necessary abilities and credentials, browse licensing and certification requirements, build a solid adjusting profile, and proactively network to locate possibilities in the insurance industry. By understanding the duty, honing required skills, getting proper licensing, and building a solid portfolio, people can position themselves for success as independent insurers. Networking special info is also vital in increasing one's chances and developing an effective career in this field.

Independent insurance adjusters play a crucial role in the insurance policy industry by investigating insurance claims, assessing plan details, examining property damage, and evaluating the degree of protection.Possessing a varied collection of abilities and credentials is essential for individuals aiming to stand out as independent insurance adjusters in the insurance policy industry.Having acquired the important abilities and certifications needed for success as an independent insurance adjuster in the insurance policy industry, the following vital action entails browsing the intricacies of licensing and qualification demands. Networking enables insurers to connect with key industry specialists, such as insurance carriers, asserts supervisors, and various other adjusters, which can lead to referrals and new assignments.In verdict, aspiring independent insurers must possess vital skills and try this out qualifications, browse licensing and qualification requirements, build a strong adjusting portfolio, and proactively network to locate chances in the insurance coverage industry.